Lhdn Tax Relief 2016

Enter the total number of children on whom full relief 100 eligibility.

Lhdn tax relief 2016. The government has also given an additional special relief of rm2 000 for tax payers earning an aggregate income of up to rm96 000 annually for the 2015 assessment year only. Amaun rm 1. We need to moderate the effects of large amounts of reliefs claimed in order to preserve equity in our tax structure.

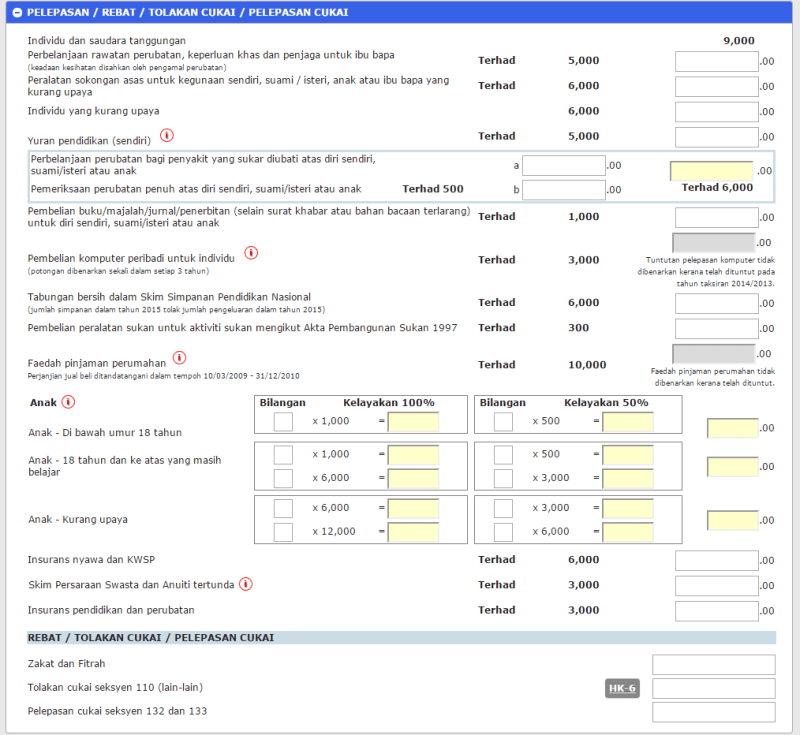

Medical expenses for parents. Personal tax relief ya 2016. Medical expenses for parents.

Only fees for technical or management services rendered in malaysia are liable to tax. Individu dan saudara tanggungan. However taken together the tax reliefs can unduly reduce the total taxable income for a small proportion of individuals.

Currently not available in lhdn website no. This relief is applicable for year assessment 2013 and 2015 only. Personal tax relief malaysia 2020.

This relief is applicable for year assessment 2013 only. Below is the list of tax relief items for resident individual for the assessment year 2019. With effect from ya 2016 until 2020 relief of rm1 500 given for a father and a mother respectively.

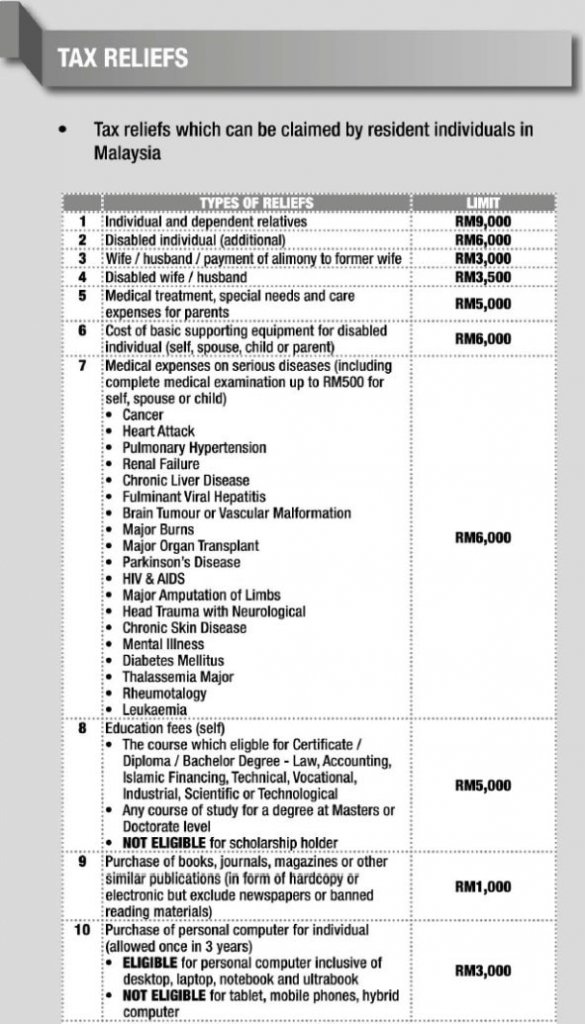

These are for certain activities or behaviours that the government encourages or even necessities or burdens to lighten our financial loads. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. 5 000 limited 3.

What is a income tax relief. The number of divorces improved by 3 2 from 51 642 cases in 2016 to 49 965 in 2017 that s still a lot of divorce cases. Hence the personal income tax relief cap was introduced in budget 2016.

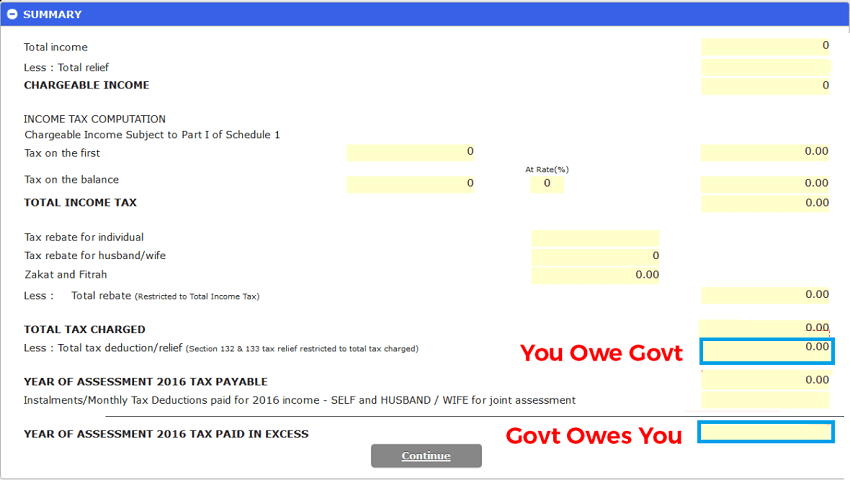

Amount rm 1. Tax administration diagnostic assessment tool tadat. Don t forget to read up on our ultimate guide to lhdn personal income tax e filing too.

Even without taking into account the many tax reliefs available every taxpayer gets the standard rm9 000 individual tax relief as well as a maximum relief of rm6 000 for epf contributions. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8.

Increased to 28 w e f ya 2016 25 for ya 2015. Tax reliefs are set by lhdn where a taxpayer is able to deduct a certain amount for money expended in that assessment year from the total annual income. Jenis potongan individu.