Loan Agreement Stamp Duty Malaysia

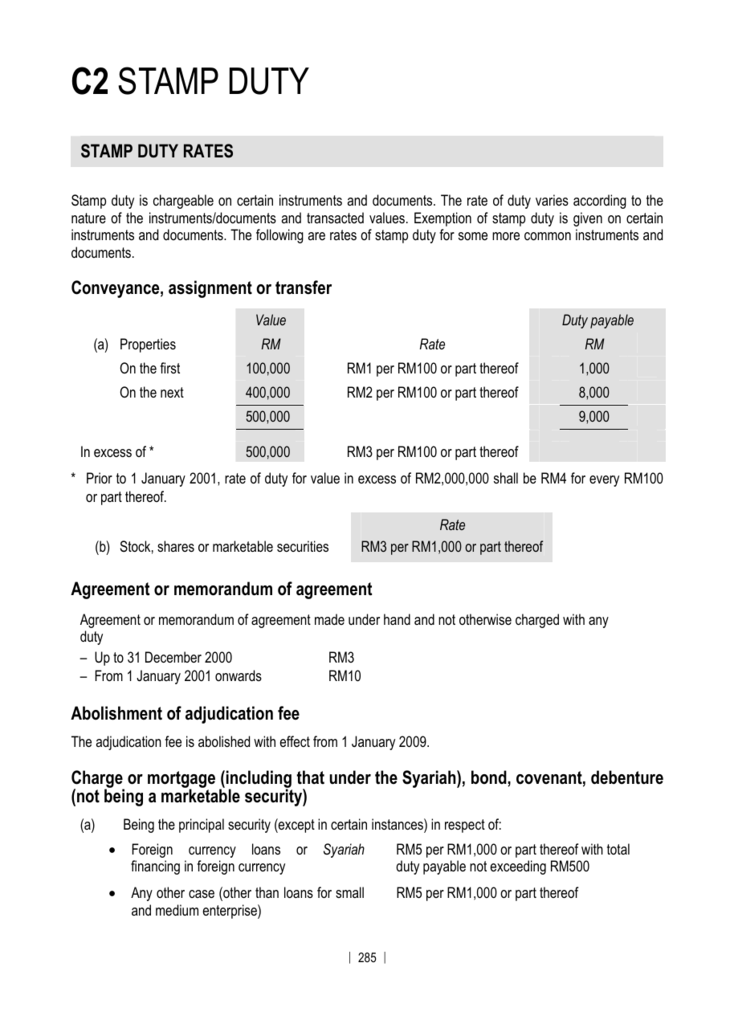

In malaysia stamp duty is a tax levied on a variety of written instruments specifies in the first schedule of stamp duty act 1949.

Loan agreement stamp duty malaysia. If the loan amount is rm300 000 the stamp duty for the loan agreement is rm300 000 x 0 50 rm1500. It s also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase. The exemption applies for a maximum loan amount of rm300 000.

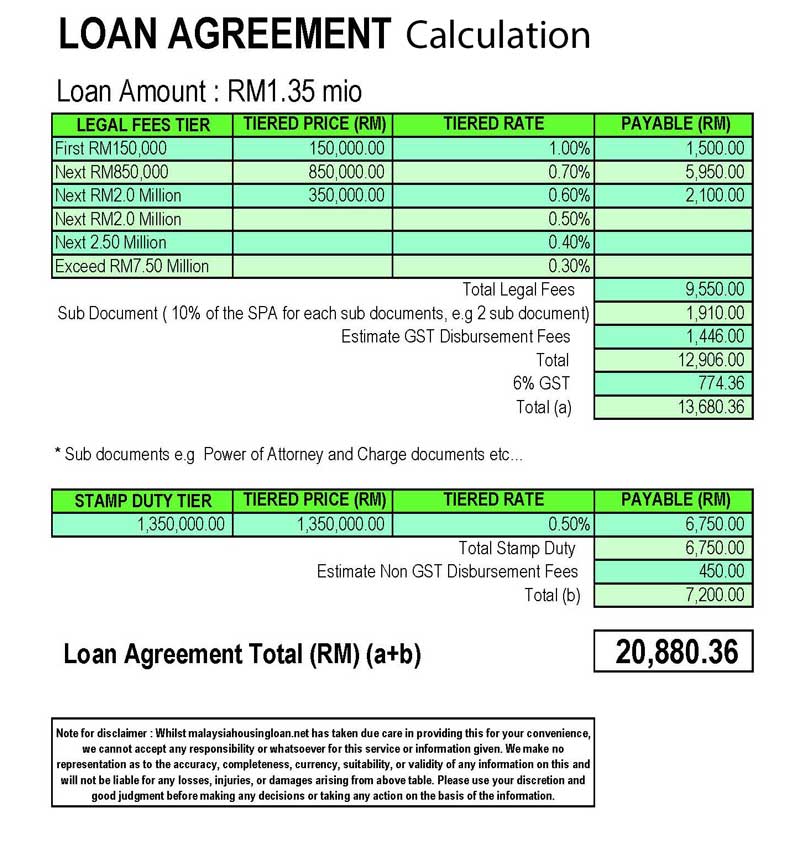

Spa loan agreement quotation includes legal fees amount disbursement fees 6 sst and stamp duty. Of property including marketable securities meaning loan stocks and shares of public companies listed on the bursa malaysia. The new stamp duty malaysia 2019 exemption for first time house buyer will be the same as the previous year stamp duty 2018 where for first time home buyers that purchasing residential properties priced up to rm500 000 stamp duty exempted up to rm300 000 on sale and purchase agreements as well as loan agreements for a period of two years until december 2020.

All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who. In general term stamp duty will be imposed to legal commercial and financial instruments. As an important legal document the loan agreement is also liable for stamp duty.

An instrument is defined as any written document and in general stamp duty is levied on legal. There are two types of stamp duty namely ad valorem duty and fixed duty. How to calculate loan agreement stamp duty.

Stamp duty on a loan agreement. For instance as part of a homeownership campaign stamp duty exemption will be given for the instruments of transfer and loan agreement for the purchase of homes valued between rm300 000 and rm2. Loan agreement loan instrument.

Stamp duty on loan agreements for the purchase of residential properties is 0 5 on the loan value. Below are the legal fees stamp duty calculation 2020 when buying a house in malaysia. It s quite simple to calculate loan agreement stamp duty.

The loan agreement stamp duty will be rm300 000 x 0 50 rm1500 00. There are no scale fees it s a flat rate of 0 50 from the total loan amount. Both quotations will have slightly different in terms of calculation.

The loan agreement stamp duty is 0 50 from the loan amount. For example if the loan amount is rm300 000. Stamp duty on a loan agreement is a flat 0 5 rate applied to the full value of the loan.