Malaysia Income Tax Relief For Parents

The prime minister announced that personal income tax relief in the amount of myr 1 000 on travel expenses incurred from 1 march 2020 to 31 august 2020 is to be extended to 31 december 2021.

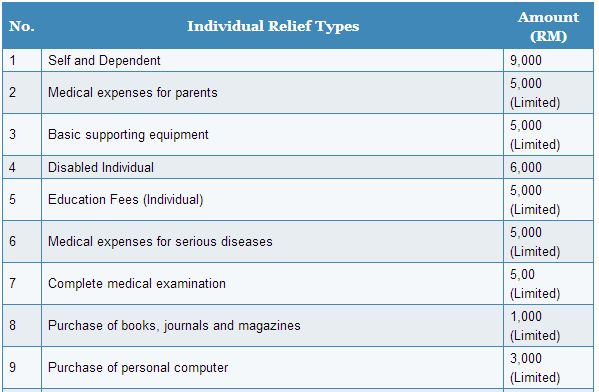

Malaysia income tax relief for parents. The easiest mistake to make in claiming income tax relief. There are various items included for income tax relief within this category which are. Self and dependentspecial relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability. Companies are not entitled to reliefs and rebates.

Medical expenses for parents. If the dependant lived in a separate household in singapore you must have incurred 2 000 or more in supporting him her in 2019. For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes.

Qualifying conditions parent relief handicapped parent relief. Scenario 1 you only have a medical card which you are paying rm 2 000 annually and you put in the entire rm 2 000 under the insurance premium for medical benefit tax relief. This relief is applicable for year assessment 2013 only.

Things to do now to maximise income tax relief lifestyle. If planned properly you can save a significant amount of taxes. Relief of rm5 000 is claimable for medical special needs or care expenses for your parents or parental tax relief if medical expenses for parents were not claimed children are entitled to collectively claim up to a maximum rm1 500 for each parent mother and father.

Under the penjana recovery plan there will also be an increase in income tax relief for parents on childcare services expenses from rm2 000 to rm3 000 however this is not applicable when you file this year as it only applies to the year of assessment. Books journals magazines printed. Rm5 000 medical expenses for parents or limited to rm3 000 parental tax.

Amount rm 1. Personal tax reliefs in malaysia. Malaysia tax relief stimulus measures for individuals.

This relief is applicable for year assessment 2013 and 2015 only. The dependant was living in your household in singapore in 2019. 5 000 limited 3.

Parents who send their children to daycare centres and kindergartens will enjoy double the amount of individual tax relief from the current rm1 000 to rm2 000.